The easiest way to manage your DeFi portfolio and make complex DeFi operations easiest way with less efforts.

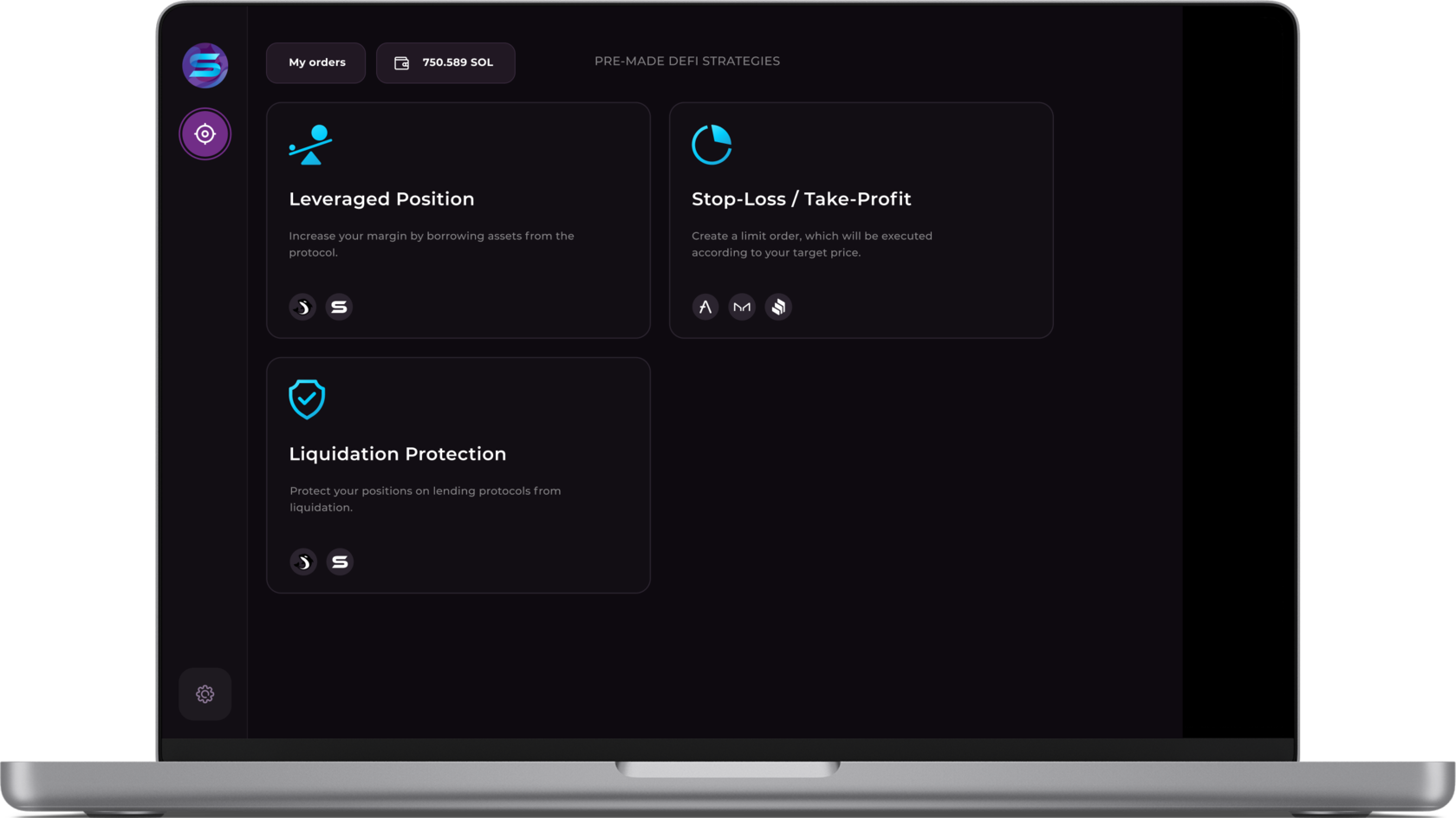

DeFi Automations

1

P2P Orders

Trustless and secure swaps between individual users.

2

Stop-loss Orders

Can be filled only if a particular price has been reached.

3

Sell Collateral

Sell your collateral in a single transaction using taker’s assets to repay a debt.

4

Lending/Borrowing

Change your collateral or debt asset

Protect your position from a liquidation.

Create a leveraged position and specify stop-loss/take-profit conditions

Protect your position from a liquidation.

Create a leveraged position and specify stop-loss/take-profit conditions

5

DEX

- Autocompounding. Automatically sell your liquidity mining rewards when a certain amount or price reached

- Liquidity management strategies. Move your liquidity between pools based on token prices

- Stablecoin strategies. Buy stablecoins at lower rates and sell at higher rates, making a profit on rate differences.

6

Create Your Own

Combine various DeFi actions, create unique protocol interactions and execute them in a single transaction.

This page was produced by the Solaris Team for internal educational and inspiration purposes only. Solaris does not encourage, induce or sanction the deployment, integration or use of Solaris or any similar application (including its code) in violation of applicable laws or regulations and hereby prohibits any such deployment, integration or use.